Timothy Ferriss's Blog, page 117

June 24, 2012

How to Lose 100 Pounds on The Slow-Carb Diet – Real Pics and Stories

Patrick lost more than 100 pounds on The Slow-Carb Diet.

I find writing very, very difficult.

While on book deadline (right now, for instance), I suffer dramatic ups and downs. In my darkest hours, I re-read reader success stories that have been sent to me. It makes the entire rollercoaster worth it.

This post will detail how readers have lost well over 100 pounds on The Slow-Carb Diet®. It was sparked by an email I received a few weeks ago:

“I just wanted to sincerely thank Tim for taking the time to research and write The 4-Hour Body. My mom, in her late 60′s, lost 45 lbs and got off her high blood pressure meds that she had been on for 20+ years. She did all this in about 3 months. This means that I get to have her around for a long time.”

Anyone can lose hope, and many people do when trying to lose weight. The Slow-Carb Diet (SCD) works almost beyond belief, and it affects much more than appearance. The basic rules are simple:

Rule #1: Avoid “white” starchy carbohydrates (or those that can be white). This means all bread, pasta, rice, potatoes, and grains. If you have to ask, don’t eat it.

Rule #2: Eat the same few meals over and over again, especially for breakfast and lunch. You already do this; you’re just picking new default meals.

Rule #3: Don’t drink calories. Exception: 1-2 glasses of dry red wine per night is allowed.

Rule #4: Don’t eat fruit. (Fructose –> glycerol phosphate –> more bodyfat, more or less.) Avocado and tomatoes are excepted.

Rule #5: Take one day off per week and go nuts. I choose and recommend Saturday.

Comprehensive step-by-step details, including Q&As and troubleshooting, can be found in The 4-Hour Body, but the above outline is often enough to lose 20 pounds in a month, drop two clothing sizes, or more.

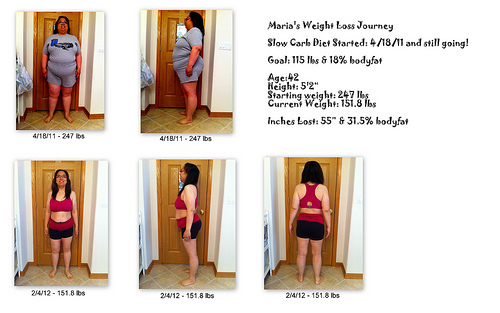

The SCD works for both women and men. Maria Rider (pictured below) is over 40 years of age and a mother. As she put it to me, she’d always been “the heavy mom.” Now she’s seen differently: “I haven’t seen this weight since my college years! I just wish you’d written the book 20 years ago!”

Last we spoke, she had dropped from 247 pounds to 122 pounds, for a loss thus far of 125 pounds. Her husband has also lost 56 pounds. (Click here for full-size image and text.)

The SCD is also effective for going from “normal” to very, very fit, as MP shows:

MP before.

MP after.

The same exact rules apply. No differences whatsoever.

—-

Next, we’ll meet Ricardo Arias… in depth. Ricardo first reached out to me via email. It began with:

I cannot put into words the great gift you have given me. “[The Slow-Carb Diet is]…intended to be effective, not fun.” As soon as I read those words, I knew I had to give the slow carb diet a try. 210 days later, I haven’t looked back. The change has been incredible. Not just my weight, but my outlook on life. I have followed your instructions to the letter…”

Below, in Ricardo’s own words, is what happens when you follow SCD to the letter.

Ricardo Arias’ Story

Ricardo Arias.

AN INTRODUCTION

People always ask me what moment led me to lose over 150 pounds in 9 months on the Slow Carb Diet (SCD).

I crack a smile when I get asked. Unlike some, who can pinpoint one moment in time which defined the start of their journey, I have three “moments” that immediately come to mind.

The first was months before I started the SCD in August of 2011. It was when I realized that overweight people on TV, told they would die because of their weight, weighed less than I did.

The second moment was the day I got my gym membership card. Instead of it prominently featuring my face, my whole midsection was featured, slumping over the chair.

The third moment, which happened just days before I began the SCD, was when a good friend told me that in order to effectuate positive change in your life, you need strength and guidance. You can acquire strength with discipline and will power, but guidance, well, that’s where Tim comes in.

I recall reading headlines in August that Amazon had just signed its first author for a new publishing arm. Not knowing who Tim Ferriss was, I did some research and found a Gizmodo article when I was at the grocery store with my shopping list. I began the SCD the very next morning. During my first few days, I was pleasantly surprised to find content and support readily available online, and how much personal feedback Tim would give via his blog. He not only provided you with a plan, but was right there with you when you had any doubts. Tim provided that little push that got me going.

How far I went then was entirely up to me.

LIFE AND STYLE

“It’s a lifestyle, not a diet.”

This is the best answer I can conjure when asked about my success on the SCD. I truly took Tim’s mantra of keeping it simple to heart. Being able to plan all of my meals ahead of time removes not only stress, but also the guilt associated with eating unhealthy foods. My previous “meal plan” consisted of eating junk food three times a day and constant snacking. Not a day would go by without having dessert, consisting of either a pint of rich ice cream or bag of cookies. Looking back, I can easy understand how I got to 410 pounds.

I have been overweight my entire life.

Whenever I managed to lose weight, I’d gain it all back. I had been open to the idea of dieting for some time but found diets too hard to follow. I would start one, and as soon as I cheated or ate incompliant foods, I would give up. This is why I knew the SCD was something I had to try. How could I pass up losing weight while not only being allowed to “cheat”, but being required to do so for an entire day out of the week?

Months after starting the SCD, I ran into an article in the UK’s Daily Mail explaining the science behind postponing eating, which further reinforced the science behind cheat day on the SCD. This, coupled with the outstanding community aspect (via blogs and personal websites), has led to my success and high compliancy rate (over 90% complaint in the past 9 months). I don’t snack, and I only drink unsweetened iced tea and black coffee. I also drink at least a gallon of water a day.

MEAL PLAN ON THE SCD — WHAT HAS WORKED FOR ME

I eat three meals a day.

- Breakfast, which I have no later than an hour after waking up.

- Lunch, which comes at least 4 hours after breakfast.

- Dinner, which is anywhere from 6-8 hours after lunch.

A typical day would look like this:

Breakfast: 8 ounces of egg whites and one whole jumbo organic egg; black beans (canned and unsalted); and steamed cauliflower.

Lunch: ½ pound of vegetarian fed tri-tip steak from trader joes; black beans (canned and unsalted); and steamed cauliflower.

Dinner: frozen chicken thighs (cooked on boiling water until thawed then fried with olive oil); black beans (canned and unsalted); and steamed cauliflower.

When I don’t have time to cook at home, I either get a chicken bowl from Chipotle (no dairy or corn) or order a carne asada (grilled steak) plate at my local burrito shop, which consists of steak, pinto beans, and a salad (no cheese).

Keeping your meals simple makes failure less likely.

CONCLUSION

Based on my experience on the SCD, the only advice I can give you is to stick with it. Your time is now. Don’t make a big fuss about it, and don’t tell it to the mountain. Keep it on the down-low for the first few weeks. This is a personal journey, and success will entirely depend on you. Tim has given you all the tools; now it’s up to you to put them to work. Keep it simple, and if you have to ask, don’t eat it. Save it for your cheat day.

I started the SCD on a Wednesday and did not have my first cheat day until the second Saturday. I invite you to take the “Wednesday Challenge” and do the same. This will give you a head start and allow you to build up will-power.

I still carry the gym membership photo in my wallet every day.

It’s constant motivation to keep at it… to continue on this wonderful, albeit challenging, journey.

I did my part, building the strength through discipline and will power to succeed on the SCD. But without Tim’s guidance, I would not be here telling you my story. Seek strength. Seek guidance.

My name is Ricardo, I am 31-years old, and I’ve lost 150 pounds on the SCD. Thank you, Tim.

Afterword from Tim

First of all, thank you, Ricardo. Sincere thanks to all of you who read what I write.

And congratulations to all who’ve made it happen!

Armed with a basic overview of the SCD and a supportive online community (like 4HBTalk), Ricardo lost 150 pounds. Similarly, the others above took a basic plan and put it into practice.

Now, I ask a small favor:

1. If you’re trying to lose fat, commit to testing The Slow-Carb Diet for two weeks starting this Wednesday. Read the above, perhaps consider The 4-Hour Body, and just get started. Put it on the calendar and make it happen.

2. If you’ve lost weight on The Slow-Carb Diet, please fill out the below! It’ll take 10 seconds and help me gather valuable data. Thank you in advance:

Fill out my online form.

(Not showing? Here’s the link.)

3. Last, if you know someone who needs (or wants) to lose weight, please tell them about Slow-Carb somehow.

I don’t care at all if they buy the book or not. The Gizmodo article and other blog links can do a great job. I’ve seen the tremendous difference it can make in the lives of entire families, not just individuals. Whether it’s life-or-death or just looking better in jeans, if you know someone who can benefit, please pass it on.

Thank you for reading, everyone, and have a wonderful week.

If you have any Slow-Carb stories (or before-and-after pics), I’d absolutely love to see them in the comments! They would truly make my summer, which is going to be a tough one…

June 19, 2012

The 4-Hour Chef: The 8-Second Book Trailer (And Competition)

What happens when you feed wine to a world-class motion designer like Adam Patch? Simultaneously, what happens when you want to avoid the super-long trend in book trailers?

An 8-second book trailer, of course.

If you think the above looks familiar, you’re right. It was converted from ridiculous to Avengers-like with post-production movie magic. The original clip was abandoned footage from The 4-Hour Body trailer. It’s embarrassing just watching it!

Think you can create a better soundtrack to the top trailer?

I’m putting $2,000 USD on the table, so show me your best on this AudioDraft page. Check out some of the tracks there, including unstarred. Really fun stuff.

If you want to try AudioDraft yourself for custom audio, use code FERRISS-JUNE to get a $99 discount until the end of June.

June 14, 2012

How to Take Intelligent Career Risk (and Win Mentoring from Reid Hoffman, Chairman of LinkedIn)

(Photo by graziedavvero)

The following post is co-authored by Ben Casnocha and Reid Hoffman. In the conclusion, there is a once-in-a-lifetime opportunity to be mentored by both of them.

Ben Casnocha is an award-winning author and serial company-builder, whom BusinessWeek has labeled “one of America’s best young entrepreneurs.” Reid Hoffman is Co-founder and Executive Chairman of LinkedIn, a Partner at iconic venture capital firm Greylock Partners, and #3 on Forbes’ 2012 Midas List. Last but not least, he’s often referred to in Silicon Valley as “The Oracle” for his seemingly prescient start-up-picking abilities…

Ben and Reid are the authors of the #1 New York Times bestseller, The Start-Up of You: Adapt to the Future, Invest in Yourself, and Transform your Career, which argues that everyone should apply the principles of entrepreneurship to their lives, even if they never plan on starting or running a company.

Enter Ben and Reid

Roll the clock back 15,000 years and play through two scenarios in your mind.

Scenario 1: It’s nearly dusk and you’re sitting on a fallen tree to rest. Suddenly you hear some rustling in the brush behind you. Instinctively, you shoot your head around. Your eyes dart back and forth searching for the source of the noise. It’s quiet for a few moments and you hear your heart pounding in your chest. Unsure what caused the noise, you spring to your feet and decide to run back to safety with the rest of your tribe.

Scenario 2: You’re walking along a dirt trail near the river. Far across the water you see the carcass of a recently killed deer. It could provide several days worth of meals but traversing the river would be arduous and time-consuming. The sun has set and if you misjudge the water depth, you might be swept away and unable to find your way back in the dark. You decide it’s not worth the trek.

Both of these decisions make sense in their own way: If you choose to stay in the woods and the rustling noise is a hungry wolf, you’re dead. If you skip going after the deer carcass, you’re not going to starve. You’ll find other food or another tribe member will. This logic is ingrained in our brain: It’s more costly to miss the sign of a threat than to miss the sign of opportunity.

The world has changed, but our brains have not

We live in a different world than that of our ancestors. We do not sit around fires and wander forests in search of food. Civilization has changed greatly, but our brains have not.

Evolution via natural selection shaped the human brain over millions of years to achieve a simple goal: stay alive long enough to reproduce and raise offspring. As a result, we react faster, stronger, and harder to threats and unpleasantness than to opportunities and pleasures. There’s a red alert in our brain for bad things, but no green alert for equivalently good things. Sticks get our attention and carrots do not, because avoiding sticks is what mattered to staying alive.

Neuropsychologist Rick Hanson sums up this “negativity bias” nicely:

“To keep our ancestors alive, Mother Nature evolved a brain that routinely tricked them into making three mistakes: overestimating threats, underestimating opportunities, and underestimating resources (for dealing with threats and fulfilling opportunities).”

Overestimating risks and avoiding losses is a fine strategy for surviving dangerous environments, but not for thriving in a modern career. When risks aren’t life-threatening, you have to overcome your brain’s disposition to avoid survivable risks. In fact, if you are not actively seeking and creating opportunities—which always contain an element of risk—you are actually exposing yourself to more serious risks in the long term.

What kinds of career risks should you take?

Risk is personal—what might be risky to a friend may not be risky to you. It’s also situational—what may be risky in one situation may not be risky if the circumstances are slightly different. But for anyone and everyone, a risk is good when the possible upside outweighs the possible downside, when the reward justifies the risk.

“All courses of action are risky, so prudence is not in avoiding danger (it’s impossible), but calculating risk and acting decisively.” – Machiavelli

Indeed, risk is an unavoidable constant of life, so your focus should be on taking the right kinds of risks that offer the right kind of opportunity.

The problem is the negativity bias — we tend to exaggerate the riskiness of certain moves and underestimate the opportunities of others. Here are some examples of frequently overstated risks, along with their associated opportunities:

Jobs that pay less in cash but offer tremendous learning.

People focus on easily quantifiable hard assets—like how much they’re getting paid in cash. But soft assets—knowledge, connections, and experiences—matter more when you’re younger. Jobs that offer less cash but more learning are too quickly dismissed as risky.

- Internships

- Apprenticeships

- High-level assistantships

Part-time gigs that are less “stable” than full-time jobs.

Many dismiss part-time gigs and contract work as being inferior to full-time jobs. But in reality, doing contract work is a terrific way to build the skills and relationships that help you pivot into the next opportunity.

- Freelance writing

- Programming

Working with someone with little relevant experience but high learning clock speed.

Fast learners make up for their inexperience in spades. The flip side of inexperience often is hustle, energy, and a willingness to learn.

- Taking a chance on a smart, scrappy person just out of college

- Partnering with someone mid-flight in a career who’s pivoting into a new industry and feeling re-energized by the challenges

An opportunity where the risks are highly publicized.

The more we hear about the downside to something, the more likely we are to overestimate the probability that it will occur (this is why people tend to become more afraid of flying after news of a plane crash is splashed across the headlines). If the media, or people in your industry, talk a lot about the riskiness of a certain job or career path, it probably isn’t as risky as most believe, and that means there’s less competition for landing the opportunity.

- Starting a company

- Working in a high tech industry

Overseas adventures.

International career opportunities involve uncertainty. There may be confusing cultural nuances or low transparency in the government. Spending time in other countries “feels” risky in part because when you’re not from a place, you initially do not understand much of the day-to-day life around you. But the best opportunities are frequently the ones with the most question marks. Don’t let uncertainty lull you into overestimating the risk. As Tim says, “Uncertainty and the prospect of failure can be very scary noises in the shadows. Most people will choose unhappiness over uncertainty.” This is true, and especially worth remembering when contemplating an international adventure.

- Foreign assignment within your company

- Attending a conference or seminar in another country

- Volunteering overseas

In all these opportunities, the worst case scenario tends to be survivable. When the worst case of a given risk means getting fired, losing a little bit of time or money, experiencing some discomfort, etc., it is a risk you should be willing to take. By contrast, if the worst-case scenario is the serious tarnishing of your reputation, or loss of all your economic assets, or something otherwise career-ending, don’t accept that risk. Asking yourself whether you can tolerate the worst case scenario is a quick and dirty way to size up risk in situations where you don’t have much information or time.

How often should you be taking risks?

If you’re reading this blog, chances are you encounter situations of risk often.

Working remotely, say, or self-experimenting with unconventional diets and blood tests. These sort of exploits introduce risk into your life in the way of volatility and uncertainty, but they are not necessarily risky things to do. The risk level doesn’t cross a threshold so as to become irrational. In fact, by pursuing new opportunities like these all the time (and accepting their associated risks), you are actually creating career stability for yourself.

Traditionally, people hold the opposite view. In 2004, two economists estimated the riskiness of working in different industries, according to the consistency of income streams and average unemployment levels of people in those careers. They referred to income fluctuations, including bouts of unemployment, as “shocks.”

By their account, risky careers (more severe shocks) included:

- Business

- Entertainment

- Sales

Non-risky careers (less severe shocks) included:

- Education

- Health care

- Engineering

The risky careers were thought to be more volatile, full of regular risks and issues, and non-risky careers were thought to be more stable. Risk-averse people are teachers, doctors, and lawyers. Risk-takers may be starting companies or trying out on Broadway.

But it’s exactly the opposite.

A low risk career is “stable” in the way a country like Syria or Saudi Arabia is stable. Dictatorships do not allow much day-to-day volatility, but when there is a fire, it can quickly turn into major chaos or even revolution. By contrast, Italy has been dealing with constant political turmoil for centuries, and has experience in responding to unexpected crises. As Joshua Ramo explains, Italy is resilient to dangerous chaos because it has absorbed frequent attacks, like “small, controlled burns in a forest, clearing away just enough underbrush to make [them] invulnerable to a larger fire.”

In the short term, low volatility means stability. Over the long run, however, low volatility leads to increased vulnerability, because it renders the system less resilient to unthinkable external shocks.

This paradox—high short-term risk leads to low long-term risk—holds true for your career.

Fragile careers vs. Resilient careers

IBM, HP, General Motors— stalwart companies that have been around a long time and employ hundreds of thousands of people. At one point in their history, each of these companies had de facto (or even explicit) policies of lifetime employment. They were the stable employers of yesterday.

While today’s employers don’t offer lifetime employment, a handful of industries still offer some semblance of stability: it’s relatively hard to be fired, your salary won’t fluctuate much, and your job responsibilities stay steady. These are the careers generally deemed less risky: government, education, engineering, health care.

But compare someone working full-time in state government to an independent real estate agent. The real estate agent doesn’t know when his next paycheck is coming. He has ups and downs. He has to hustle to build a network of clients and keep up with changes in the market. His income is lumpy, and sporadic big wins (selling a multimillion-dollar home) keep him alive. The government worker, by contrast, gets a steady paycheck and an automatic promotion every couple years. He always eats well . . . until the day comes that government pensions explode or austerity measures wipe out his department. Now he’s screwed. He will starve because, unlike the real estate agent, he has no idea how to deal with the downs.

Or compare a staff editor at a prestigious magazine to a freelance writer. The staff editor enjoys a dependable income stream, regular work, and a built-in network. The freelance writer has to hustle every day for gigs, and some months are better than others. The staff editor is always well fed; the freelance writer goes hungry some days. Then the day comes when print finally dies. The industry crumbles, the magazine folds, and the staff editor gets laid off. Having built up no resilience, he will starve. He’s less equipped to bounce to the next opportunity, whereas the freelance writer has been bouncing around her whole life—she’ll be fine.

So which type of career is riskier over the long run?

Today’s world is full of change and unpredictable disruption. Unless you take frequent, contained risks, you are setting yourself up for a major dislocation at some point in the future. Inoculating yourself to big risks requires taking small, regular risks—it’s like doing controlled burns in a forest. By introducing regular volatility into your career, you make surprise survivable. You gain “the ability to absorb shocks gracefully.” You become resilient as you take risks and pursue opportunities.

Take, for instance, moving to Santiago, Chile for nine months.

I hoped an international living experience (distinct from a travel experience) would jog new sorts of learning and opportunity. I went to Chile with no set plan, no fluency in the language, and never having lived in another country outside of the US. I had butterflies in my stomach when I was packed my bags. There was immense uncertainty. I swallowed through that uncertainty on the faith that the cultural stimulation alone would be worth it, even if my social/professional/linguistic goals weren’t realized.

Looking back now on those nine months, it was an unmatched growth experience for me.

What will be your unmatched growth experience?

Final thoughts from Reid

For my first job after grad school, Apple hired me into their user experience group. Shortly after starting on the job, I learned that product/market fit—the focus of product management—actually mattered more than user experience or design. You can develop great and important user interfaces, and Apple certainly did, but if customers don’t need or want the product, they won’t buy. At Apple, and in most companies, the product/market fit questions fall under the purview of the product management group, not user experience. And because product management is vital in any product organization, work experience in the area tends to lead to more diverse career opportunities.

I attempted to iterate into a product management role within Apple. But the product management jobs required product management experience. It’s a common catch-22: for jobs that require prior experience, how do you get the experience the first time?

My solution: do the job for free on the side. I sought out the head of product management within the eWorld group at Apple and told him I had a few product ideas. I offered to write them up in addition to everything else I was doing, and I did. It was a risk: my boss could have been annoyed I wasn’t focused on my existing responsibilities; given my lack of experience, there was a decent chance the product ideas I wrote up were going to be bad, thus making a bad first impression to product folks within Apple; my youthful proactiveness could have been seen as naïve brashness.

But the risk worked out in the end–I got good feedback on my moonlit product plans, and I ultimately acquired enough experience to land a full-time product management job at Fujitsu after Apple. Of course, not all risks work out—but this story of volunteering-to-do-extra-work sticks with me as a career risk I am very happy I sought out, as it set in motion a series of other key opportunities.

[On one other risk that paid off]

I joined the board of PayPal while I was working at Socialnet, my first company. Normally entrepreneurs are told to maintain extreme focus on their company and day job, so joining a board of another company at the time was a risk. I establishedprotocols with Peter and Max to make sure the PayPal commitment wouldn’t interfere too much with Socialnet – e.g. I promised to them back by midnight if they had questions, which meant discussion in the evening hours, not 9-5 normal workday hours. As it turned out, Socialnet was soon to be winding down operations so I pivoted to work at PayPal full-time in January, 2000. The board position risk proved wise in hindsight because, in addition to being a learning opportunity in its own right, it set me up for a full pivot to Plan B. In other words, the PayPal side-project risk meant I traded down on focus in exchange for a broader set of learnings and increased mobility for my next career move.

4 keys to becoming a more resilient, intelligent risk taker

1. Remember your negativity bias will cause you to exaggerate your evaluation of certain risks. Whatever it is you’re thinking about doing, there’s probably not as much risk involved as you think.

2. Identify—and take on—risks that are acceptable to you, but that other people tend to avoid. Are you okay having less money in savings and taking a low-paying but high-learning job? Or maybe a month-to-month employment contract as opposed to something longer term? Go find a project with these sorts of risks. It will differentiate you from others.

3. Say “yes” more. What would happen if you defaulted to “yes” for a full day? A full week? If you say yes to the conference invite you were tempted to skip, might you overhear a comment that ignites your imagination for a new business or new research or a new relationship? Perhaps. Might it also lead to some dead ends, mishaps, and wasted time? Sure. But trying new, small things every day introduces regular risks that, over time, build up your resilience to big disruptions.

4. Now it’s your turn. Leave a comment on this post, introduce yourself, and tell us:

- What change do you want to make in your career in the next 30-60 days? (e.g. Change jobs, ask for a raise, find a new opportunity within your company)

- How are you thinking about the risk involved in this move?

We’ll select the person who leaves the most thoughtful comment no later than 5pm PST, June 21 (Thursday), and personally invest in making that person’s next career move successful.

Here’s what we can offer:

- Over email and in a 30-minute phone call, we’ll suggest relevant opportunities, key people to meet, and provide motivational support. The initial 30-minute call will be with me (Ben), and the follow-up emails will include Reid.

- Two signed copies of The Start-Up of You.

- Your story will be highlighted in our LinkedIn Group.

- Free Linkedin Premium subscription

Think of this as a personalized high-impact session on how to take your next best step by embracing (or creating) the right types of risk.

###

Odds and Ends: App Contest Winner

Chad Mureta has chosen the winner of the app contest in his previous how-to post on building an app empire. Thanks to all for your submissions! Here’s his announcement:

The winner of the contest is Alex Kourkoulas. His app idea: “Legend: Put meme-like captions on your photos and share them with friends.”

Our top two favorite runner-ups:

Dina S. Her app: “Teacher Text: Quick, easy SMS communication with teachers. Students can text questions about homework, quizzes, tests, or class projects. Students can also register to receive texts containing project or assignment details, due dates, quiz & text reminders, resources, class announcements, etc. No personal phone numbers would be displayed within the app, just usernames. Teachers can add and group students based on their class period, allowing for easy group texts of vital class-related information. Parents can register to receive a copy of all texts sent and received, allowing them to stay in the loop.”

Bill Rosado. His app: “Phone Home: Automatic calling/texting a designated number when the phone arrives at a predetermined destination. Great for teenagers or elderly parents!:”

June 11, 2012

Exclusive Warren Buffett – A Few Lessons for Investors and Managers

“This [drawing] looks good — as close as I’ve ever look to George Clooney.” – Warren Buffett. (Illustration credit: Monica Bevelin)

“It’s a funny thing about life; if you refuse to accept anything but the best, you very often get it.”

-W. Somerset Maugham

English dramatist & novelist (1874 – 1965)

I have long been a fan of Warren Buffett, who is widely considered the most successful investor of the 20th century. His net worth is currently estimated at $44 billion.

The fascination with his approach to value investing started with Buffett: The Making of An American Capitalist, which led me to devour all of Buffett’s incredibly readable annual letters to Berkshire Hathaway shareholders. My fervor culminated in early May of 2008, when I made the pilgrimage to Omaha, Nebraska to elevator pitch Buffett and Charlie Munger directly in front of 20,000+ people (See: “Picking Warren Buffett’s Brain: Notes from a Novice”).

Prompted by all the “Mr. Market” manic-depressive excitement about Facebook, tech, and the world at large, I’m thrilled to offer an exclusive excerpt from a new 81-page book: A Few Lessons for Investors and Managers from Warren E. Buffett.

In it, author Peter Bevelin distills hundreds of pages of annual reports and Berkshire’s An Owner’s Manual into bite-sized principles and key quotes. Of this lightweight handbook, Buffett himself says, “It sums up what Charlie and I have been saying over the years in annual reports and at annual meetings.”

Net proceeds from sales of A Few Lessons are donated to the California Institute of Technology in Pasadena, California. It can be bought at the publisher’s site, which is their preference, or it can be found on Amazon.

For this post, I’ve chosen one of my favorite chapters, which relates to Buffett’s criteria for investments (and acquisitions): Business Characteristics: The Great, the Good, and the Gruesome…

The bolded headlines and text are Peter’s.

Enter Buffett – Business Characteristics: The Great, the Good, and the Gruesome

Our acquisition preferences run toward businesses that generate cash, not those that consume it. (1980)

And those are:

The best businesses by far for owners continue to be those that have high returns on capital and that require little incremental investment to grow. (2009)

A. THE REALLY GREAT BUSINESS: High returns, a sustainable competitive advantage and obstacles that make it tough for new companies to enter

A truly great business must have an enduring “moat” that protects excellent returns on invested capital. (2007)

“Moats”—a metaphor for the superiorities they possess that make life difficult for their competitors. (2007)

Moats can widen or shrink

Long-term competitive advantage in a stable industry is what we seek in a business. (2007)

Leadership alone provides no certainties: Witness the shocks some years back at General Motors, IBM and Sears, all of which had enjoyed long periods of seeming invincibility. (1996)

The dynamics of capitalism guarantee that competitors will repeatedly assault any business “castle” that is earning high returns. Therefore a formidable barrier such as a company’s being the low cost producer (GEICO, Costco) or possessing a powerful world-wide brand (Coca-Cola, Gillette, American Express) is essential for sustained success. Business history is filled with “Roman Candles,” companies whose moats proved illusory and were soon crossed. (2007)

One question I always ask myself in appraising a business is how I would like, assuming I had ample capital and skilled personnel, to compete with it. (1983)

If a business requires a superstar to produce great results, the business itself cannot be deemed great. A medical partnership led by your area’s premier brain surgeon may enjoy outsized and growing earnings, but that tells little about its future. The partnership’s moat will go when the surgeon goes. You can count, though, on the moat of the Mayo Clinic to endure, even though you can’t name its CEO. (2007)

A great business has pricing power or the power to raise prices without losing business to a competitor

An economic franchise arises from a product or service that:

(1) Is needed or desired; (2) Is thought by its customers to have no close substitute and; (3) Is not subject to price regulation. The existence of all three conditions will be demonstrated by a company’s ability to regularly price its product or service aggressively and thereby to earn high rates of return on capital. Moreover, franchises can tolerate mis-management. Inept managers may diminish a franchise’s profitability, but they cannot inflict mortal damage. (1991)

The best protection against inflation is a great business

Such favored business must have two characteristics: (1) An ability to increase prices rather easily (even when product demand is flat and capacity is not fully utilized) without fear of significant loss of either market share or unit volume, and (2) An ability to accommodate large dollar volume increases in business (often produced more by inflation than by real growth) with only minor additional investment of capital. (1981)

As inflation intensifies, more and more companies find that they must spend all funds they generate internally just to maintain their existing physical volume of business. (1980)

Any unleveraged business that requires some net tangible assets to operate (and almost all do) is hurt by inflation. Businesses needing little in the way of tangible assets simply are hurt the least. (1983)

The dream business—“sweet” returns

Let’s look at the prototype of a dream business, our own See’s Candy. (2007)

In our See’s purchase, Charlie and I had one important insight:

We saw that the business had untapped pricing power. (1991)

At See’s, annual sales were 16 million pounds of candy when Blue Chip Stamps purchased the company in 1972… Last year See’s sold 31 million pounds, a growth rate of only 2% annually. Yet its durable competitive advantage, built by the See’s family over a 50-year period, and strengthened subsequently by Chuck Huggins and Brad Kinstler, has produced extraordinary results for Berkshire. (2007)

We bought See’s for $25 million when its sales were $30 million and pre-tax earnings were less than $5 million. The capital then required to conduct the business was $8 million. (Modest seasonal debt was also needed for a few months each year.) Consequently, the company was earning 60% pre-tax on invested capital. Two factors helped to minimize the funds required for operations. First, the product was sold for cash, and that eliminated accounts receivable. Second, the production and distribution cycle was short, which minimized inventories. (2007)

Last year See’s sales were $383 million, and pre-tax profits were $82 million. The capital now required to run the business is $40 million.

This means we have had to reinvest only $32 million since 1972 to handle the modest physical growth—and somewhat immodest financial growth—of the business. In the meantime pre-tax earnings have totaled $1.35 billion. All of that, except for the $32 million, has been sent to Berkshire (or, in the early years, to Blue Chip). After paying corporate taxes on the profits, we have used the rest to buy other attractive businesses. (2007)

Customer goodwill creates economic goodwill

See’s has a one-of-a-kind product “personality” produced by a combination of its candy’s delicious taste and moderate price, the company’s total control of the distribution process, and the exceptional service provided by store employees. (1986)

It was not the fair market value of the inventories, receivables or fixed assets that produced the premium rates of return. Rather it was a combination of intangible assets, particularly a pervasive favorable reputation with consumers based upon countless pleasant experiences they have had with both product and personnel. (1983)

Such a reputation creates a consumer franchise that allows the value of the product to the purchaser, rather than its production cost, to be the major determinant of selling price. Consumer franchises are a prime source of economic Goodwill. (1983)

A company like See’s is a rarity

There aren’t many See’s in Corporate America. Typically, companies that increase their earnings from $5 million to $82 million require, say, $400 million or so of capital investment to finance their growth. That’s because growing businesses have both working capital needs that increase in proportion to sales growth and significant requirements for fixed asset investments. (2007)

A company that needs large increases in capital to engender its growth may well prove to be a satisfactory investment. There is, to follow through on our example, nothing shabby about earning $82 million pre-tax on $400 million of net tangible assets. But that equation for the owner is vastly different from the See’s situation. It’s far better to have an ever-increasing stream of earnings with virtually no major capital requirements. Ask Microsoft or Google. (2007)

B. THE GOOD BUSINESS: Earn good returns on tangible

invested capital

One example of good, but far from sensational, business economics is our own Flight Safety. This company delivers benefits to its customers that are the equal of those delivered by any business that I know of. It also possesses a durable competitive advantage: Going to any other flight-training provider than the best is like taking the low bid on a surgical procedure. (2007)

Nevertheless, this business requires a significant reinvestment of earnings if it is to grow. When we purchased FlightSafety in 1996, its pre-tax operating earnings were $111 million, and its net investment in fixed assets was $570 million. Since our purchase, depreciation charges have totaled $923 million. But capital expenditures have totaled $1.635 billion, most of that for simulators to match the new airplane models that are constantly being introduced. (A simulator can cost us more than $12 million, and we have 273 of them.) Our fixed assets, after depreciation, now amount to $1.079 billion. Pre-tax operating earnings in 2007 were $270 million, a gain of $159 million since 1996. That gain gave us a good, but far from See’s-like, return on our incremental investment of $509 million. (2007)

High capital intensity requires high profit margins to achieve a

decent return

At FlightSafety…as much as $3.50 of capital investment is required to produce $1 of annual revenue. With this level of capital intensity, FlightSafety requires very high operating margins in order to obtain reasonable returns on capital, which means that utilization rates are

all-important. (2004)

Consequently, if measured only by economic returns, Flight Safety is an excellent but not extraordinary business. Its put-up-more-to-earn-more experience is that faced by most corporations. (2007)

C. THE GRUESOME: Require-a-lot-of-capital-at-a-low-return-business

The worst sort of business is one that grows rapidly, requires significant capital to engender the growth, and then earns little or no money. Think airlines. Here a durable competitive advantage has proven elusive ever since the days of the Wright Brothers. (2007)

Asset-heavy businesses generally earn low rates of return—rates that often barely provide enough capital to fund the inflationary needs of the existing business, with nothing left over for real growth, for distribution to owners, or for acquisition of new businesses. (1983)

A depressing industry equation—undifferentiated products, easy to enter, many competitors and over-capacity

Businesses in industries with both substantial over-capacity and a “commodity”product (undifferentiated in any customer-important way by factors such as performance, appearance, service support, etc.) are prime candidates for profit troubles. (1982)

What finally determines levels of long-term profitability in such industries is the ratio of supply-tight to supply-ample years. Frequently that ratio is dismal. (1982)

If…costs and prices are determined by full-bore competition, there is more than ample capacity, and the buyer cares little about whose product or distribution services he uses, industry economics are almost certain to be unexciting. They may well be disastrous. (1982)

In many industries, differentiation can’t be made meaningful

Hence the constant struggle of every vendor to establish and emphasize special qualities of product or service. This works with candy bars (customers buy by brand name, not by asking for a “two-ounce candy bar”) but doesn’t work with sugar (how often do you hear, “I’ll have a cup of coffee with cream and C & H sugar, please”). (1982)

Some make money but only if they are the low-cost operator

When a company is selling a product with commodity-like economic characteristics, being the low-cost producer is all-important. (2000)

A few producers in such industries may consistently do well if they have a cost advantage that is both wide and sustainable. By definition such exceptions are few, and, in many industries, are non-existent. (1982)

With superior management, a company may maintain its status as a low-cost operator for a much longer time, but even then unceasingly faces the possibility of competitive attack. And a business, unlike a franchise, can be killed by poor management. (1991)

Or find a protected niche

Someone operating in a protected, and usually small, niche can sustain high profitability levels. (1987)

Or when supply is tight

When shortages exist…even commodity businesses flourish. (1987)

But it may take time

Over-capacity may eventually self-correct, either as capacity shrinks or demand expands. Unfortunately for the participants, such corrections often are long delayed. (1982)

And it usually doesn’t last long

One of the ironies of capitalism is that most managers in commodity industries abhor shortage conditions—even though those are the only circumstances permitting them good returns. (1987)

When they finally occur, the rebound to prosperity frequently produces a pervasive enthusiasm for expansion that, within a few years, again creates over-capacity and a new profitless environment. In other words, nothing fails like success. (1982)

But in some industries, tightness in supply can last a long time

Sometimes actual growth in demand will outrun forecasted growth for an extended period. In other cases, adding capacity requires very long lead times because complicated manufacturing facilities must be planned and built. (1982)

Berkshire’s unfortunate experience with the textile industry

The domestic textile industry operates in a commodity business, competing in a world market in which substantial excess capacity exists. Much of the trouble we experienced was attributable, both directly and indirectly, to competition from foreign countries whose workers are paid a small fraction of the U.S. minimum wage. (1985)

And whatever improvements Berkshire did, competitors did

Slow capital turnover, coupled with low profit margins on sales, inevitably produces inadequate returns on capital. Obvious approaches to improved profit margins involve differentiation of product, lowered manufacturing costs through more efficient equipment or better utilization of people, redirection toward fabrics enjoying stronger market trends, etc. Our management is diligent in pursuing such objectives.

The problem, of course, is that our competitors are just as diligently doing the same thing. (1978)

Over the years, we had the option of making large capital expenditures in the textile operation that would have allowed us to somewhat reduce variable costs. Each proposal to do so looked like an immediate winner. Measured by standard return-on-investment tests, in fact, these proposals usually promised greater economic benefits than would have resulted from comparable expenditures in our highly-profitable candy and newspaper businesses. (1985)

I see the immediate but illusory benefits of the cost reductions. I don’t see competitive actions and that all the benefits go to the customer

But the promised benefits from these textile investments were illusory. Many of our competitors, both domestic and foreign, were stepping up to the same kind of expenditures and, once enough companies did so, their reduced costs became the baseline for reduced prices industry wide. Viewed individually, each company’s capital investment decision appeared cost-effective and rational; viewed collectively, the decisions neutralized each other and were irrational (just as happens when each person watching a parade decides he can see a little better if he stands on tiptoes). After each round of investment, all the players had more money in the game and returns remained anemic. (1985)

Thus, we faced a miserable choice: Huge capital investment would have helped to keep our textile business alive, but would have left us with terrible returns on ever-growing amounts of capital. After the investment, moreover, the foreign competition would still have retained a major, continuing advantage in labor costs. A refusal to invest, however, would make us increasingly non-competitive, even measured against domestic textile manufacturers. (1985)

This devastating outcome for the shareholders indicates what can happen when much brain power and energy are applied to a faulty premise. The situation is suggestive of Samuel Johnson’s horse:

“A horse that can count to ten is a remarkable horse—not a remarkable mathematician.” Likewise, a textile company that allocates capital brilliantly within its industry is a remarkable textile company—but not

a remarkable business. (1985)

An important lesson

We react with great caution to suggestions that our poor businesses can be restored to satisfactory profitability by major capital expenditures. (The projections will be dazzling and the advocates sincere, but, in the end, major additional investment in a terrible industry usually is about as rewarding as struggling in quicksand.) (An Owner’s Manual)

An important truth

In a business selling a commodity-type product, it’s impossible to be a lot smarter than your dumbest competitor. (1990)

But what if I buy a gruesome business at a real bargain?

If you buy a stock at a sufficiently low price, there will usually be some hiccup in the fortunes of the business that gives you a chance to unload at a decent profit, even though the long-term performance of the business may be terrible. I call this the “cigar butt” approach to investing. A cigar butt found on the street that has only one puff left in it may not offer much of a smoke, but the “bargain purchase” will make that puff all profit. (1989)

Don’t confuse “cheap” with a good deal

Unless you are a liquidator, that kind of approach to buying businesses is foolish. First, the original “bargain” price probably will not turn out to be such a steal after all. In a difficult business, no sooner is one problem solved than another surfaces—never is there just one cockroach in the kitchen. (1989)

Second, any initial advantage you secure will be quickly eroded by the low return that the business earns. For example, if you buy a business for $8 million that can be sold or liquidated for $10 million and promptly take either course, you can realize a high return. But the investment will disappoint if the business is sold for $10 million in ten years and in the interim has annually earned and distributed only a few percent on cost. Time is the friend of the wonderful business, the enemy of the mediocre. (1989)

In some businesses, not even brilliant management helps

I’ve said many times that when a management with a reputation for brilliance tackles a business with a reputation for bad economics, it is

the reputation of the business that remains intact. (1989)

Good jockeys will do well on good horses, but not on broken-down

nags. (1989)

When an industry’s underlying economics are crumbling, talented management may slow the rate of decline. Eventually, though, eroding fundamentals will overwhelm managerial brilliance. (As a wise friend told me long ago, “If you want to get a reputation as a good businessman, be sure to get into a good business.”) (2006)

My conclusion from my own experiences and from much observation of other businesses is that a good managerial record (measured by economic returns) is far more a function of what business boat you get into than it is of how effectively you row (though intelligence and effort help considerably, of course, in any business, good or bad). (1985)

Should you find yourself in a chronically-leaking boat, energy devoted

to changing vessels is likely to be more productive than energy devoted to patching leaks. (1985)

Turnarounds seldom turn or take longer than I expect

Both our operating and investment experience cause us to conclude that “turn-arounds” seldom turn, and that the same energies and talent are much better employed in a good business purchased at a fair price than in a poor business purchased at a bargain price. (1979)

But separate a general and permanent problem from an isolated and correctable problem and temporary setback—assuming it’s a great or good business

Extraordinary business franchises with a localized excisable cancer (needing, to be sure, a skilled surgeon), should be distinguished from the true “turnaround” situation in which the managers expect—and need—to pull off a corporate Pygmalion. (1980)

A great investment opportunity occurs when a marvelous business encounters a one-time huge, but solvable, problem as was the case many years back at both American Express and GEICO. Overall, however, we’ve done better by avoiding dragons than by slaying them. (1989)

All earnings are not created equal—Restricted earnings must often

be discounted heavily in capital intensive businesses

In many businesses particularly those that have high asset/profit ratios—inflation causes some or all of the reported earnings to become ersatz. The ersatz portion—let’s call these earnings “restricted”—cannot, if the business is to retain its economic position, be distributed as dividends. Were these earnings to be paid out, the business would lose ground in one or more of the following areas: Its ability to maintain its unit volume of sales, its long-term competitive position, its financial strength. No matter how conservative its payout ratio, a company that consistently distributes restricted earnings is destined for oblivion unless equity capital is otherwise infused. (1984)

Let’s turn to the much-more-valued unrestricted variety. These earnings may, with equal feasibility, be retained or distributed. In our opinion, management should choose whichever course makes greater sense for the owners of the business. (1984)

Unrestricted earnings should be retained only when there is a reasonable prospect—backed preferably by historical evidence or, when appropriate, by a thoughtful analysis of the future—that for every dollar retained by the corporation, at least one dollar of market value will be created for owners. This will happen only if the capital retained produces incremental earnings equal to, or above, those generally available to investors. (1984)

D. OTHER TOUGH BUSINESSES

I-have-to-be-smart-every-day-business

Retailing is a tough business… In part, this is because a retailer must stay smart, day after day. Your competitor is always copying and then topping whatever you do. Shoppers are meanwhile beckoned in every conceivable way to try a stream of new merchants. In retailing, to coast

is to fail. (1995)

In contrast to this have-to-be-smart-every-day business, there is what I call the have-to-be-smart-once business. For example, if you were smart enough to buy a network TV station very early in the game, you could put in a shiftless and backward nephew to run things, and the business would still do well for decades. (1995)

Fast changing industries can also be troublesome—even if I understand their products, it may be close to impossible to judge future competitive position and what can go wrong over time

Our criterion of “enduring” causes us to rule out companies in

industries prone to rapid and continuous change… A moat that must

be continuously rebuilt will eventually be no moat at all. (2007)

In the past, it required no brilliance for people to foresee the fabulous growth that awaited such industries as autos (in 1910), aircraft (in 1930) and television sets (in 1950). But the future then also included competitive dynamics that would decimate almost all of the companies entering those industries. Even the survivors tended to come away bleeding. (2009)

A business that constantly encounters major change also encounters many chances for major error. Furthermore, economic terrain that is forever shifting violently is ground on which it is difficult to build a fortress-like business franchise. Such a franchise is usually the key to sustained high returns. (1987)

And this includes technology—a few will make money but many will lose and it’s hard to see who does what in advance

A business that must deal with fast-moving technology is not going to lend itself to reliable evaluations of its long-term economics. (1993)

At Berkshire, we make no attempt to pick the few winners that will emerge from an ocean of unproven enterprises. We’re not smart enough to do that, and we know it. (2000)

Did we foresee thirty years ago what would transpire in the television-manufacturing or computer industries? Of course not. (Nor did most of the investors and corporate managers who enthusiastically entered those industries.) Why, then, should Charlie and I now think we can predict the future of other rapidly-evolving businesses? (1993)

Severe change and exceptional returns usually don’t go together.

Most investors, of course, behave as if just the opposite were true. That is, they usually confer the highest price-earnings ratios on exotic-sounding businesses that hold out the promise of feverish change.

That prospect lets investors fantasize about future profitability rather than face today’s business realities. For such investor-dreamers, any blind date is preferable to one with the girl next door, no matter how desirable she may be. (1987)

Just because Charlie and I can clearly see dramatic growth ahead for

an industry does not mean we can judge what its profit margins and returns on capital will be as a host of competitors battle for supremacy.

At Berkshire we will stick with businesses whose profit picture for decades to come seems reasonably predictable. Even then, we will make plenty of mistakes. (2009)

Our problem—which we can’t solve by studying up—is that we have

no insights into which participants in the tech field possess a truly durable competitive advantage. (1999)

And growth has its limits—no trees grow to the sky

In a finite world, high growth rates must self-destruct. If the base from which the growth is taking place is tiny, this law may not operate for a time. But when the base balloons, the party ends: A high growth rate eventually forges its own anchor. (1989)

For a major corporation to predict that its per-share earnings will grow over the long term at, say, 15% annually is to court trouble. That’s true because a growth rate of that magnitude can only be maintained by a very small percentage of large businesses. Here’s a test: Examine the record of, say, the 200 highest earning companies from 1970 or 1980 and tabulate how many have increased per-share earnings by 15% annually since those dates. You will find that only a handful have. I would wager you a very significant sum that fewer than 10 of the 200 most profitable companies in 2000 will attain 15% annual growth in earnings-per-share over the next 20 years. (2000)

We readily acknowledge that there has been a huge amount of true value created in the past decade by new or young businesses, and that there is much more to come. But value is destroyed, not created, by any business that loses money over its lifetime, no matter how high its interim valuation may get. (2000)

Our lack of tech insights, we should add, does not distress us. After all, there are a great many business areas in which Charlie and I have no special capital-allocation expertise. For instance, we bring nothing to the table when it comes to evaluating patents, manufacturing processes or geological prospects. So we simply don’t get into judgments in those fields. (1999)

E. THE CORRECT WAY TO LOOK AT ACCOUNTING GOODWILL

We believe managers and investors alike should view intangible assets from two perspectives: (1983)

When you evaluate the attractiveness of a business look at the return on net tangible assets

(1) In analysis of operating results—that is, in evaluating the underlying economics of a business unit-amortization charges should be ignored. What a business can be expected to earn on unleveraged net tangible assets, excluding any charges against earnings for amortization of Goodwill, is the best guide to the economic attractiveness of the operation. It is also the best guide to the current value of the operation’s economic Goodwill. (1983)

Goodwill should not be amortized, but written off when necessary

(2) In evaluating the wisdom of business acquisitions, amortization charges should be ignored also. They should be deducted neither from earnings nor from the cost of the business. This means forever viewing purchased Goodwill at its full cost, before any amortization. Furthermore, cost should be defined as including the full intrinsic business value—not just the recorded accounting value—of all consideration given, irrespective of market prices of the securities involved at the time of merger and irrespective of whether pooling treatment was allowed. (1983)

Operations that appear to be winners based upon perspective (1) may pale when viewed from perspective (2). A good business is not always a good purchase—although it’s a good place to look for one. (1983)

We will try to acquire businesses that have excellent operating economics measured by (1) and that provide reasonable returns measured by (2). Accounting consequences will be totally ignored. (1983)

F. WHAT ARE THE KEY FACTORS FOR SUCCESS OR HARM AND HOW PREDICTABLE ARE THEY?

Let’s translate the analysis into a simple question: Does the business have something people need or want now and in the future (demand), that no one else has (competitive advantage) or can copy, take away or get now and in the future (sustainable) and can these advantages be translated into business value?

Investors should remember that their scorecard is not computed using Olympic-diving methods: Degree-of-difficulty doesn’t count. If you are right about a business whose value is largely dependent on a single key factor that is both easy to understand and enduring, the payoff is the same as if you had correctly analyzed an investment alternative characterized by many constantly shifting and complex variables. (1994)

The truly big investment idea can usually be explained in a short paragraph. (1994)

Distinguish what matters from what doesn’t—Try to figure out the key factors that make the business succeed or fail. A few examples:

Insurance

Our main business…is insurance. To understand Berkshire, therefore, it is necessary that you understand how to evaluate an insurance company. The key determinants are: (1) The amount of float that the business generates; (2) Its cost; and (3) Most critical of all, the long-term outlook for both of these factors. (1999)

The most important ingredient in GEICO’s success is rock-bottom operating costs, which set the company apart from literally hundreds of competitors that offer auto insurance. (1986)

Because of the company’s low costs, its policyholders were consistently profitable and unusually loyal. (2010)

Newspapers

Within this environment the News has one exceptional strength: its acceptance by the public, a matter measured by the paper’s “penetration ratio”—the percentage of households within the community purchasing the paper each day… We believe a paper’s penetration ratio to be the best measure of the strength of its franchise. (1983)

A large and intelligently-utilized news hole…attracts a wide spectrum of readers and thereby boosts penetration. High penetration, in turn, makes a newspaper particularly valuable to retailers since it allows them to talk to the entire community through a single “megaphone.” A low-penetration paper is a far less compelling purchase for many advertisers and will eventually suffer in both ad rates and profits. (1989)

Retail

We regard the most important measure of retail trends to be units sold per store rather than dollar volume. (1983)

NFM [Nebraska Furniture Mart] and Borsheim’s [Fine Jewelry] follow precisely the same formula for success: (1) unparalleled depth and breadth of merchandise at one location; (2) the lowest operating costs in the business; (3) the shrewdest of buying, made possible in part by the huge volumes purchased; (4) gross margins, and therefore prices, far below competitors’; and (5) friendly personalized service with family members on hand at all times. (1989)

Railroads

Both of us are enthusiastic about BNSF’s future because railroads have major cost and environmental advantages over trucking, their main competitor. Last year BNSF moved each ton of freight it carried a record 500 miles on a single gallon of diesel fuel. That’s three times more fuel-efficient than trucking is, which means our railroad owns an important advantage in operating costs. (2010)

To sum up the great, good and gruesome

To sum up, think of three types of “savings accounts.” The great one pays an extraordinarily high interest rate that will rise as the years pass. The good one pays an attractive rate of interest that will be earned also on deposits that are added. Finally, the gruesome account both pays an inadequate interest rate and requires you to keep adding money at those disappointing returns. (2007)

Business experience, direct and vicarious, produced my present strong preference for businesses that possess large amounts of enduring Goodwill and that utilize a minimum of tangible assets. (1983)

—

Published with permission from Post Scriptum AB.

### For the comments: Do you have any favorite investment or investor quotes? ###

June 7, 2012

Announcing “The Influencer 100″, Apps, and Start-up News

Tech influencer Kevin Rose giving me love in Okinawa.

This will be short. Several quick and very fun updates:

- The 4-Hour Body® app is now live, as is the stripped-down The Slow-Carb Diet® App. Enjoy, and please provide feedback in the comments! NOTE: iPhone coming up… sign up for the beta here.

- I am working with an incredible new start-up called Quarterly.co. I’ll be sending out boxes of physical products I love to subscribers every three months (details coming soon). In addition, I’ll be sending my 4x/year packages to the “Influencer 100” — 100 friends of mine who all create tipping points.

These 100 include top tech “influencers” with audiences of 1-10+ million, star professional athletes, A-list Hollywood actors, “Midas List” venture capitalists, and much more. Nowhere else can you get the captive attention of people like Kevin Rose (tech) and Chase Jarvis (photography/entertainment) at once, just to name two.

Would you like to get your product (physical, not digital) in front of the top tastemakers in the US, these “Influencer 100″? Just fill out this form and let me know.

Other start-up opportunities:

BranchOut is hiring a Search Architect. Over 25 million users. Big Data. Raised $49 million. Huge opportunity! Email for job candidates to apply: jobs (at) branchout [dot] com

CrowdFlower – Use the code TFMR0512 with our new crowdsourced photo moderation app at rtfm.crowdflower.com and get 5000 images moderated for free. Use the code TFSENTI to get early access to our crowdsourced twitter sentiment app at senti.crowdflower.com.

Stealth Mobile Commerce Startup – Looking for iOS, Rails, and/or Haskell hackers. Small, highly technical/product oriented team (4 engineers). YC, top-tier VC-backed. Send your Github to missionhackerhouse (at) gmail [dot] com

DailyBurn – For a 30-day free membership exclusive to readers of this blog, visit this page.

May 31, 2012

The Most Successful E-mail I Ever Wrote

2008 blast from the past: me, Mike Wallin, and Derek Sivers, the subject of this post. (Photo: A3maven)

[Total read time: 3-5 minutes.]

Derek Sivers is one of my favorite people. He is a programmer who lost his stage fright by doing more than 1,000 gigs as a circus ring leader (!!!).

He’s also a musician who founded CD Baby in 1998. As of December 2009, CD Baby had the following stats as the world’s largest online distributor of independent music:

- 300,000 artists

- 5,339,025 CDs sold online to customers

- $200,000,000+ paid directly to the artists

Derek sold the company in 2008, and he did so in a most unusual fashion (bolding mine):

Sivers sold CD Baby to Disc Makers in 2008 for what Sivers has reported to be $22 million, bequeathing, upon Sivers’ death, the principal to a charitable trust for music education.; while alive, according to Sivers, it “pays out 5% of its value per year to me.”

Wikipedia

I know this to be true.

Stranger still, at its largest, Derek spent roughly four hours on CD Baby every six months! He had systematized everything to run without him. Derek is both more successful and more fulfilled because he never hesitates to challenge the status quo, to test assumptions. The below guest post from him illustrates this beautifully.

Without further ado, the most successful e-mail he ever wrote…

Enter Derek Sivers

When you make a business, you’re making a little world where you control the laws. It doesn’t matter how things are done everywhere else. In your little world, you can make it like it should be.

When I first built CD Baby, every order had an automated e-mail that let the customer know when the CD was actually shipped. At first it was just the normal, “Your order has shipped today. Please let us know if it doesn’t arrive. Thank you for your business.”

After a few months, that felt really incongruent with my mission to make people smile. I knew could do better. So I took 20 minutes and wrote this goofy little thing:

Your CD has been gently taken from our CD Baby shelves with sterilized contamination-free gloves and placed onto a satin pillow.

A team of 50 employees inspected your CD and polished it to make sure it was in the best possible condition before mailing.

Our packing specialist from Japan lit a candle and a hush fell over the crowd as he put your CD into the finest gold-lined box that money can buy.

We all had a wonderful celebration afterwards and the whole party marched down the street to the post office where the entire town of Portland waved “Bon Voyage!” to your package, on its way to you, in our private CD Baby jet on this day, Friday, June 6th.

I hope you had a wonderful time shopping at CD Baby. We sure did. Your picture is on our wall as “Customer of the Year”. We’re all exhausted but can’t wait for you to come back to CDBABY.COM!!

–

That one silly e-mail, sent out with every order, has been so loved that if you search Google for “private CD Baby jet” you’ll get over 20,000 results. Each one is somebody who got the e-mail and loved it enough to post on their website and tell all their friends.

That one goofy e-mail created thousands of new customers.

When you’re thinking of how to make your business bigger, it’s tempting to try to think all the big thoughts, the world-changing massive-action plans.

But please know that it’s often the tiny details that really thrill someone enough to make them tell all their friends about you.

###

TIM: Do not miss Derek’s blog, which is full of these gems. It’s one of the few blogs I take the time to read. If you want to see how Derek and I compare approaches, here is a starting point.

May 24, 2012

Six-Figure Businesses Built for Less Than $100: 17 Lessons Learned

Photo: 401K.

The following article is a guest post by Chris Guillibeau, who’s traveled to 150+ countries and studied more micro-businesses than anyone I know. I hope you love this piece as much as I did. Enjoy!

Enter Chris

Over the past several years, I’ve been on a quest to study micro-businesses—small operations (typically one person) that make $50,000 a year or more (often a lot more). The quest took me all over the world, at first to a large group of 1,500 “unexpected entrepreneurs” who volunteered to share their stories in detail.

I wanted to hear from all kinds of businesses–both offline and online–to decipher what made them so successful. How did they get started? What helped them grow into significant, reliable sources of income? How can you increase odds of success?

After much effort, a small team and I narrowed down the case studies to a subset of 70 that I focused on for final analysis. All 70 people had created freedom for themselves: new income and a completely new way of life. There are formulas.

Here is a highly-condensed list of 17 lessons learned…

The 17 Lessons of $100 Start-ups

Note: Links show the businesses in action.

A gap in the marketplace reveals a business opportunity.

Gary Leff used his Frequent Flyer Miles to travel all over the world in First Class, and his friends kept asking for advice. Almost on a whim, he decided to launch a basic website offering the service of booking travel awards for a fee.

His service is something that people could do on their own for free—but plenty of people don’t know how it works or just don’t want the hassle of dealing with airline call centers. This “side business” now brings in more than $100,000 a year.

Lesson: Provide results (photos, testimonials, details of your own experiences) and offer to do something for people that they don’t know how to do or don’t want to worry about.

Latch on to a popular service, then simplify it for others.

Self-described “professional nerd” Brett Kelly wrote Evernote Essentials, the first English-language manual for the popular Evernote software. Brett was hoping for a $10,000 payday over the course of a few months—enough to pay off some bills. Instead, he received $10,000 in two days… and then the sales kept coming.

Originally conceived as a hobby that Brett worked on during nights and weekends, Evernote Essentials now earns more than $160,000 a year in net income. Here’s what Brett says about the results: “The unreal success of this project has not only freed our family from a decade of debt and financial instability, but has also given us the freedom to pursue the kind of life we want.”

Lesson: Simplify things and cash in. Brett developed a comprehensive resource with lots of screenshots and detailed, highly actionable tips. More than 10,000 customers later, it’s still going strong.

Don’t beg your friends for money!

You probably don’t need any outside investment to begin. The vast majority of respondents in the study started their business for less than $1,000, and nearly half for $100 or less. In Vancouver, Canada, Nicolas Luff started with only $56.33, the cost of a business license. Others started only with a domain name and a free WordPress account.

It wasn’t just online businesses that started on the cheap. Michael Hanna started an unconventional mattress store after being laid off from his job in media sales. A friend of his who owned a furniture store offered him an unwanted truckload of mattresses, figuring that Michael could sell them one at a time on Craigslist. Instead of Craigslist, though, Michael found a car dealership that had recently gone out of business. He was able to rent the space at a huge discount, and he opened his first store while learning on the job.

Even though Michael originally knew nothing about the mattress business, three years later Mattress Lot produces more than $1 million in revenue.

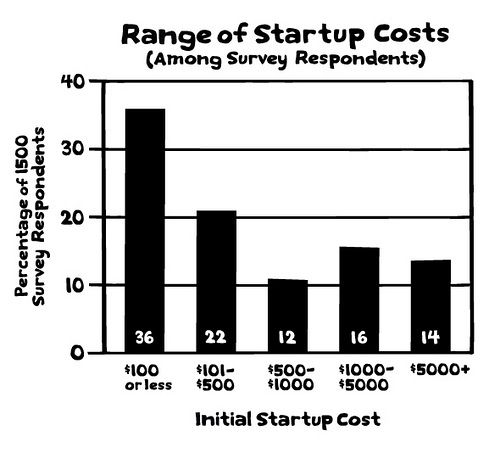

The chart below illustrates the average startup cost from the businesses we examined.

Image Credit: Mike Rohde.

Note: I sometimes hear from people who say that not all businesses can be started on the cheap. This is true. If you want to open a factory, you might need more than $100. If you want to found a VC-backed tech start-up, you might need to woo investors. But the point remains: you can start many different kinds of businesses without going into debt. All things are equal, why not take that route if the costs are low?

Lesson: Whenever possible, start quickly and start cheap. (And most of the time, it is possible.)

If you do need money, you can find a way.

Emma Reynolds had an idea for a consultancy that would work with big companies to improve their staffing and resourcing. She calculated that she would need at least $17,000 to start the new firm. There was just one problem: Emma was 23 and unlikely to get a business loan.

Emma and her business partner Bruce realized that despite this, they could probably get a car loan. Bruce proceeded to do just that, borrowing $17,000 for a car and then investing the funds in the business with Emma instead. They paid back the car loan within ten months, and the bank never found out that there was no actual car. Now the profitable firm employs twenty people and has multiple offices in four countries.

Another example: Shannon Oakey was turned down for a small bank loan despite excellent financials and a strong business plan. Shannon took her business elsewhere: to Kickstarter, where her project was fully funded. Shannon printed out a copy of the final results and mailed it to the loan officer who had rejected her—with a lollipop inside the printout.

Lesson: If you really need a loan, don’t take “no” as the final answer. Consider alternatives. Bootstrap. Hustle. Figure it out. (Note: Borrowing money for a non-existent car is at your own risk!)

Get to the first sale as quickly as possible.

Nick Gatens put up a portfolio site for his photographs and sold a $50 print for the first time. What’s the big deal? When you’ve never sold something before–i.e. never had a stranger comes to your website and hands over their credit card–the first time is flooring. Here’s what Nick said:

“It took me a long time to add the order button on my site. For a while I kept blaming it on technical issues—a WordPress glitch, the need for design improvement, and so on. Finally I realized I was waiting for no good reason. I put the offer out there and made a sale. It felt great!”

Lesson: Does your site have a PayPal button on it? If not, add one today!

A trend or controversial idea can also reveal a business opportunity.

Jason Glaspey was a follower of Paleo, the controversial diet that is both loved and ridiculed. Jason noticed a common problem among fellow devotees: because of the requirement for regular shopping and planning, Paleo was hard to follow on a regular basis.

Jason created Paleo Plan, a membership site that offers shopping lists and ongoing guidance. The goal of Paleo Plan is to keep its customers on track, with detailed shopping lists and ongoing recommendations. The project now brings in more than $5,000 a month.