Jennifer Becton's Blog, page 2

May 16, 2018

The Marketing Department: Action-Movie Marketing (Part 2)

The Marketing Department: Action-Movie Marketing

Every author’s goal is to make their books visible to the widest audience possible, but the simple fact is that not every reader will be interested in every book. Therefore, some level of marketing focus is needed.

Stop Pray-and-Spray Marketing

Have you ever watched an action movie from the 1980s? The hero usually has a massive automatic weapon that never seems to need reloading. To make it even less realistic, the shooter never actually takes aim at the target before pulling the trigger and launching a single, well-aimed bullet. Instead, he sprays 10,000 bullets in the general direction of the bad guy. Take this scene from Predator for example:

Certainly, the goal of marketing is to get your book in front of as many people as possible. But if you aren’t making it visible to the right people, then you’re wasting a ton of time and money. It doesn’t matter how many times a person sees your book if they dislike the genre. They’re never going to purchase or read it.

So don’t market like an action film, throwing out a thousand ads indiscriminately and hoping to hit the right person eventually. Instead, pause, take aim, and use the minimum amount of ammo possible. Market more often to people who you know are already interested in your books–or in books very similar to yours. Don’t just pray and spray.

Take Aim: Define Your Target Audience

Describe your average reader. Having a general understanding of who reads your books will help you tailor ads to appeal to them.

Are they predominately male or female? Or are they a mix of both?

How old are they?

Where do they live?

What other books do they enjoy?

What other media do they consume? TV shows, movies, music?

What other authors do they enjoy?

What social media outlets to they use? (Facebook, Twitter, Instagram, Snapchat, Pinterest, etc?)

What devices do they read on?

Where do they purchase their books? Which stores?

Use your answers to help guide your targeted ads. Narrow your audience so that you have the most chance of connecting with people who are already interested in the type of book you have written. Then, tailor each ad to suit the viewer and the venue. Don’t run the same thing on every platform. A Tweet should look different than a Pin. But all of them should be designed to appeal to your audience.

Conserve Your Ammo: Make Each Ad Count

Not all your marketing should be a call to action or a push to purchase. Marketing really comes down to relationship building (aka making friends). Sometimes just having a pleasant conversation on Twitter can be better marketing than a major ad campaign.

When you do run an ad, make it count. Design it specifically with your friends (aka readers) in mind. Would your readers be more likely be on Instagram or Snapchat? What sort of pictures or videos would appeal to them? What hashtags will reach other demographics who share an interest in your genre?

When you do run an ad, make it count. Design it specifically with your friends (aka readers) in mind. Would your readers be more likely be on Instagram or Snapchat? What sort of pictures or videos would appeal to them? What hashtags will reach other demographics who share an interest in your genre?

ProTip: Keep records of your results and experiment to determine the best ads to run.

Advertise free items, not just those you have available for purchase. Free items might not make you a dollar right now, but they can offer you a great deal down the road. For example, you could offer the first book in a series free for a limited time. If readers enjoy the free intro to your series, they will be likely to purchase the subsequent books. Or you could offer a free short story to people who opt in to your email list.

Opt-ins: Social Media and Email Lists

Social media and email lists represent two different sorts of opt-ins, and they require different styles of marketing. While both types are voluntary–readers choose to see your content–people expect different things and will be put off if you do not behave appropriately for each venue.

Social Media Opt-ins. People choose to view your posts on Facebook (whether as a fan page or group), Twitter, Pinterest, Instagram, and Snapchat. Or they may search your subject out on their own using search features and hashtags. Either way, you are not broadcasting to the whole world. You are speaking to individuals who have chosen to follow you or are interested in the subject matter you discuss. Yes, your audience will expecting some amount of book-sales style posts. However, this is social media. They also expect you to be interact like a normal human, not like a commercial set to repeat. Nothing is more off-putting than following an author only to find that their entire feed looks like a giant, non-stop ad.

ProTip: use the 80/20 rule for marketing here. Spend 80 percent of your time making friends, sharing photos, or posting funny memes. Use only 20 percent of your social media time on advertising.

Email List Opt-ins. An email list is the ultimate marketing tool. Why? Because there’s no guesswork. You know these people are already interested specifically in you and your books. They chose to join your email list, and that means more than following you on social media. They invited you to send your content directly to their personal realm: their inbox.

Use this privilege wisely.

The people on your email list are your friends and biggest supporters. They have purchased your books in the past, and unless something goes wrong, they will continue to do so in the future. Find ways to thank them. You could offer discounts and coupons or exclusive free content, like short stories or deleted scenes.

No bait and switch! When you set up your email list, tell people what you intend to send them, and then send only that. If you plan a chatty weekly newsletter, let them know. If you’re going to recommend other writers (aka essentially run ads for other books), tell them ahead of time. If you only intend to send book launch announcements, let them know that too. No matter what you plan to send, make sure your readers know what to expect and when to expect it. Then respect them enough to give it to them.

That’s really what marketing is about. Making friends and then respecting them enough to sell only when appropriate. But knowing when to sell and when not to can be tricky. In the following posts in the Marketing Department, we’ll talk specifically about how to market (or not market) on book discussion forums like Goodreads and Amazon.

Want to keep up with the Book Business for Indie Publishers series?

Want to keep up with the Book Business for Indie Publishers series?

Sign up for email notifications and receive free spreadsheet templates and PDFs for use in your own business!

#mc_embed_signup{background:#fff; clear:left; font:14px Helvetica,Arial,sans-serif; width:100%;}

/* Add your own MailChimp form style overrides in your site stylesheet or in this style block.

We recommend moving this block and the preceding CSS link to the HEAD of your HTML file. */

Yes, Keep Me Updated!

April 16, 2018

The Marketing Department (Part 1)

The Marketing Department

When it comes to book marketing, writers usually have one of two possible reactions:

Extreme Digust

Extreme Exuberance

Both can be equally bad.

Extreme Disgust: Write, Publish, and Hope for the Best

Writers who fall into the first category of Extreme Disgust just want to write, publish, and hope for the best. They trust that booksellers’ algorithms will make their books visible, and people will buy them based on the cover, description, and sample.

This only works to a certain degree. Algorithms are fickle, ever-changing beasts. You might be humming along with consistent sales, and then wham! The algorithm changes. And suddenly, you’re sales trickle off to nothing.

Sure, you could always wait for another algorithm change, but a smart writer diversifies their marketing. Do more than one thing to be seen.

Extreme Exuberance: Sell Everywhere All the Time

Writers who fall into the second category of Extreme Exuberance try to sell everywhere all the time. Not only do they use booksellers’ algorithms, but they pay for ads all the time. Every tweet is a sales pitch, and each Facebook post contains a buy link. Every page on their author website has eighty-seven pop-ups, urging visitors to opt in to something or make a purchase.

The worst of the too-exuberant marketers overly engage with readers on vendor forums, in book discussion groups, in frequent email blasts, etc. No matter where they are, they market. Heavily. These types of marketers tend to come off as invasive and obnoxious. In fact, most forums where readers and writers engage have created strict rules to prevent authors from making a nuisance of themselves.

A Happy Medium: Be Engaged But Not Too Excited

The most effective marketers fall somewhere in the 1.5 range. They are engaged with the marketing process, but not so excited that all they do is make sales pitches. One of best ways to ensure engagement without over exuberance is to be conscious of what you are doing. How are you coming off to your potential readers? Do your best to show that you a human with other interests and ideas. People don’t want to be sold to all the time.

In short, you need to find the way that best suits your personality to become visible to potential readers without driving them insane.

And that brings us to the biggest question on every writer’s mind: how? What is the best way to build an audience? We’ll explore some of the options in the Marketing Department.

Want to keep up with the Book Business for Indie Publishers series?

Want to keep up with the Book Business for Indie Publishers series?

Sign up for email notifications and receive free spreadsheet templates and PDFs for use in your own business!

#mc_embed_signup{background:#fff; clear:left; font:14px Helvetica,Arial,sans-serif; width:100%;}

/* Add your own MailChimp form style overrides in your site stylesheet or in this style block.

We recommend moving this block and the preceding CSS link to the HEAD of your HTML file. */

Yes, Keep Me Updated!

April 13, 2018

Friday Five: Things I Do Not Like To Read

Disclaimer: I do not hate most of these things. In fact, I read and watch shows that contain these plot devices or characteristics. However, I do not actively seek out these types of stories, and for me to enjoy them, they have to be exceptional.

1. Deep, Dark Secrets

I generally do not enjoy books that focus on deep, dark family secrets. They’re basically stories about people who refuse to speak to each other frankly, sometimes spanning multiple generations. No, thanks. I don’t love mistaken identity stories for the same thing. If the plot of a whole movie or book could be completely derailed by someone saying, “No, my name is actually John Smith,” then most of the time, I just don’t want to bother with it.

2. Ignoring the Obvious Question

I gave up on the TV show Lost because no one ever asked the obvious question of people who might know that answer. Someone needed to ask, “Hey, what is that smoke monster all about?” Even if the answer is “I don’t know,” the question needed to be asked. If it becomes clear that whatever I’m reading or watching is all about presenting 10,000 confounding situations, but no one asks the obvious question, I’m out of there.

3. Boy Wizards

I love a good supernatural tale. Give me monsters, ghosts, walkers, zombies, and even vampires. My supernatural proclivities swing more in the direction of The X-Files rather than Harry Potter. I’m just not that into spell-casting magic. In general, I don’t seek out books about witches, wizards, warlocks, and other spell-throwing whatnots. I know I’m a backward bumpkin, but I haven’t read any Harry Potter. *dodges stones* I’m not knocking it or any fans. I just can’t get into it.

4. Addicts in Recovery as Main Characters

I spend all my time waiting for the usually inevitable relapse, so I have a hard time enjoying anything else that’s going on. This most likely stems from my preference for comedy over tragedy. These stories are usually grim.

5. City Settings

I have nothing against cities, but I enjoy reading about settings other than Chicago, Los Angeles, and New York. I searched for a mystery that took place in a small town but wasn’t classified as a cozy mystery. I wanted a serious, gritty crime that just happened to take place outside of a booming metropolis. (That’s why I wrote one.) Small-town detectives can be skilled investigators who simply don’t have every available resource available at a moment’s notice. Plus, readers get to travel to different venues and meet interesting locals.

Now that I’ve list Five Things I Like to Read and Five Things I Don’t Like to Read, next week, I’m going to confess the exceptions to those rules.

What sorts of things do you tend to avoid reading or watching?

April 6, 2018

Friday Five: What I Love to Read (or Watch)

One of the best ways to find yourself as a writer–or heck, even as a reader–is to make a list of the types of stories that you love to read. This will help you decide what to write or purchase. Here are five things that I love in books and in TV shows and movies.

1. Comedies (as Opposed to Tragedies)

Comedies are stories of people overcoming hardship; tragedies focus on characters who are overcome by hardship. The comedies I’m talking about aren’t necessarily slapstick nonsense, but they do end on a positive note. Lots of people seem to think that tragedies are somehow superior, but I’ve always thought it was easier to write a story that ended with sorrow. Writing a deep story–without glossing over or diminishing difficulties–about people who overcome the hardships of life is much harder. It’s easy to be negative. It’s difficult to be positive. I want to read–and write–the more challenging thing.

It’s not just me who thinks this way. In his book, The Hero with a Thousand Faces, Joseph Campbell writes:

Tragedy is the shattering of the forms and of our attachments to the forms; comedy, the wild and careless, inexhaustible joy of life invincible.

He also says:

“[Comedies], in the ancient world, were regarded as of a higher rank than tragedy, of a deeper truth, of a more difficult realization, of a sounder structure, and of a revelation more complete. The happy ending of the fairy tale, the myth, and the divine comedy of the soul, is to be read, not as a contradiction, but as a transcendence of the universal tragedy of man…. Tragedy is the shattering of the forms and of our attachments to the forms; comedy, the wild and careless, inexhaustible joy of life invincible.”

2. Interesting Characters

Give me the quirks and the foibles. Show me the rough edges and the awkwardness. More points if you can make me like the quirky oddballs and the grumps. I want to see these people overcoming the challenges in their lives.

3. HEA: Happily Ever After

This is closely tied to number 1, but I’m mentioning it twice because it’s kind of a big deal for me. Every plot thread doesn’t have to be tied up perfectly, but I want the characters I love to end up happily for the most part.

4. Character Development

It’s not enough for characters to be interesting. House was an interesting character, but I lost my interest when I read an interview with Hugh Laurie that said he didn’t think audiences liked it when characters changed. Change is what I live for. In real life, people grow and change. Therefore, characters should also grow and change. If they never change, then there’s no point in reading or watching because you’ll see the same thing over and again. Pass.

Carol’s first appearance in The Walking Dead. She’s ironing in the apocalypse.

Carol’s first appearance in The Walking Dead. She’s ironing in the apocalypse. Badass Carol in later seasons.

Badass Carol in later seasons.

5. Mixed Genres

I’m an eclectic reader. I love books that cross genres. Give me a crime dramedy or a spy comedy or a small town mystery (not a cozy mystery). One of the greatest aspects of the TV show Longmire (and the books on which it was based) is that it could be classified as a modern western crime drama. There were vicious murders and rapes, but instead of being handled in NYC or Chicago with all the big-city resources (like every other crime drama), it took place in Absaroka County, Wyoming, with very few murders solved in the forensics lab. I found it refreshing to see crimes solved by going out and talking to people instead of investigating a fiber in the lab.

What do you look for in books and shows?

April 4, 2018

12 Habits of Highly Productive Writers (with Commentary)

via Wiley

via WileyThis infographic came through my Pinterest feed the other day, and it has some useful information to help maximize your writing output.

Let’s take them one at a time.

They reject the notion of “writer’s block.” I don’t believe it exists. “Writer’s block” is actually a symptom of a different problem. That problem could be almost anything: physical exhaustion, stress, fear, lack of inspiration, or even a problem with the manuscript in question. The way to overcome “writer’s block” is to identify to real cause and deal with that problem.

They don’t overtalk their projects. While it’s good to have a logline or an elevator pitch to give to friends, editors, and publishers, writers write more than they talk about what they’re writing. It’s easy, especially for extroverts, to get wrapped up in tossing around ideas with fellow authors. Write first and then talk.

They believe in themselves and their work. Every writer has to believe in the value of their work. Sometimes it’s easy to think that fiction is less valuable than other books. But entertainment has value. Ask yourself what your reader get from your work: entertainment, information, inspiration?

They know that a lot of important stuff happens when they’re not “working.” Your subconscious is always busy gathering inspiration and making connections. In fact, your subconscious knows what it wants to write before your conscious mind starts to think about an outline. You just have to have the courage to let your subconscious have its way. Be ready to record your ideas wherever you are. Keep a notepad by the bed, in your purse, in the car, on the refrigerator. You never know when an idea will strike, and you don’t want to lose it!

They’re passionate about their projects. If you, the writer, are not excited about your work, how can you expect the reader to be? That’s why I recommend writing what you love. If you do that, your passion will show, and your readers will be swept away into your world of writing.

They know what they’re good at. Having a realistic understanding of your tastes and talents is essential for having an enjoyable, prolific career. Write what you love, and write using the methods that suit you. Some writers outline or use note cards to lay out their entire book. If that works for you, keep it up. But there’s nothing wrong if your process is different. Figure out what works for you, and keep doing it. Don’t stop there though. Ponder your weaknesses and work to improve those too.

They read a lot and widely. Almost all lists of writing advice contain the admonition to read. Extensive reading is key to knowing what you love and understanding how books work, how they flow. Nonfiction is also important for research purposes and general knowledge.

They know how to finish a draft. This is what differentiates an aspiring writer from a working writer. Every manuscript goes through a period where all the fun, creative writing is done, and you’re left writing transition scenes or doing copy editing. It would be easy to set aside the book and move onto a new, fun story. And that’s okay if you are writing as a hobby. If you want to make writing writing your career, you have to plow through the boring parts.

They work on more than one thing at once. Multitasking is essential, especially if you self-publish. Not only do you have to work on your current writing project, but you have to market your previous projects, manage sales, do giveaways, pay your taxes, and send royalties to your coauthors or those you publish.

They leave off at a point where it will be easy to start again. People who write for a living set themselves up for success. The image of a “starving artist” may have some twisted, romantic appeal for some, but writers don’t write themselves into a corner and then quit. At the very least, they formulate a plan for how to get over the tough part. Having a plan keeps writers motivated to write more.

They don’t let themselves off the hook. The only person you hurt by making excuses is yourself. Refer to item 8 on this list. Writers don’t stop until they have gone from plan to published.

They know there are no shortcuts, magic bullets, special exercises or incantations. Writers know that they have to do the work to make their dreams come true.

And that’s what this is all about: doing the hard work to make dreams come true. What are you doing today to make your dreams come true?

April 2, 2018

The Finance Department: Federal Income Taxes (Part 4)

Federal Income Taxes: Standard Deductions vs. Itemized Deductions (

AKA How Not to Commit Fraud)

Federal Income Taxes: Standard Deductions vs. Itemized Deductions (

AKA How Not to Commit Fraud)

The Finance Department (Part 4)

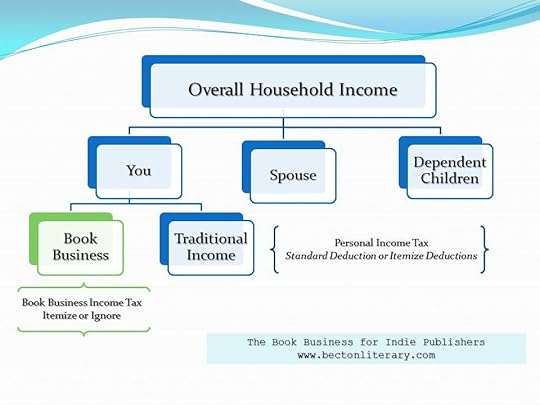

As you can see from the chart above, your book business falls under your personal income tax umbrella, but let’s break it down even further.

Itemized vs. Standard Deductions

When you file your personal income taxes, you have two choices: itemize deductions or use the standard deduction. Both serve to lower your taxable income, but you have to do a little math in order to figure out which option saves you the most money.

Standard Deduction: The standard deduction is a fixed dollar amount that reduces the income you’re taxed on. Your standard deduction varies according to your filing status (your marital status and senior status, among other things). It’s best to use this deduction if your itemized deductions do not exceed your standard deduction.

Itemized Deductions: Itemized deductions also lower the amount of income you pay taxes on. The amount saved depends on your tax bracket and how many expenses you can legitimately claim. These are itemized personal deductions, not your book business expenses.

Book Business Deductions

You also have two choices when it comes to your book business. You can either itemize your deductions, which means keeping receipts and records, or you can ignore your expenses and pay more in taxes. Last week’s post covered business expenses that you can write off, items like mileage, shipping, advertising, royalties you paid to writers you publish, etc.)

You can also write off your home office. A portion of certain household expenses can be written off under the business-side of the umbrella.

Why? Because some of your book business income went to pay for portions of your book business office (the portion of your home you use for work). You do not pay taxes on income you did not actually keep.

Potential Work from Home Deductions

Because you work from home, you can deduct a portion of your:

property taxes

utilities (water bill, electric bill, natural gas bill, etc.)

interest on your home mortgage or rent

insurance

cell phone bill (if used for business)

business miscellany (toilet paper, hand soap, etc.)

Portion is the keyword. You must come up with an estimate of what portion of your home expenses are actually business expenses. You could base your estimate on the number of rooms or on the square feet in your house. Decide what percentage of your house is used for your book business. Don’t just pick a number out of thin air. Make sure you can defend that number if an auditor asks you how you came up with it.

But wait. There’s a catch. It’s an either or situation. You can either deduct certain items from the business category or the home category. You cannot deduct the same expense from both places. That’s called fraud. However, you can deduct a portion from business and then you can deduct the remaining portion from home.

Unique circumstances exist for each individual or family, so pay attention. If you itemize, you cannot write off the same expense twice: once for business and once for personal.

For example:

Let’s say you have a $1,000 property tax bill and claim 10 percent of your house as your book business office.

You can claim $100 of your property tax bill as a business expense and $900 from your overall personal expenses.

Claiming $100 as a business expense and $1000 on your home expenses is fraud.

If you aren’t sure about your deductions, hire a professional, but remember that you are still responsible for the recordkeeping and for the documents you file.

Disclaimer : Don’t trust me. Go to IRS.gov and confirm the information for yourself. I’m not responsible if you get audited. Also, state income taxes are separate beasts, and you’ll have to tame them for yourselves unless you are fortunate enough to live in a state without them.

Want to keep up with the Book Business for Indie Publishers series?

Want to keep up with the Book Business for Indie Publishers series?

Sign up for email notifications and receive free spreadsheet templates and PDFs for use in your own business!

#mc_embed_signup{background:#fff; clear:left; font:14px Helvetica,Arial,sans-serif; width:100%;}

/* Add your own MailChimp form style overrides in your site stylesheet or in this style block.

We recommend moving this block and the preceding CSS link to the HEAD of your HTML file. */

Yes, Keep Me Updated!

March 30, 2018

Friday Five: Top Netflix Bingewatches

1. The Office

True confession: I have watched The Office at least a dozen times. Probably more. Every time through the series, I am struck by how the writers make me root for even the least likable characters on the show. Michael can be at his most childish at one moment and then do something genuinely caring and kind the next. Sometimes I want to smack him, but I always want him to succeed. #thatswhatshesaid

2. Stranger Things

The X-Files meets The Goonies: what’s not to like? But seriously, the writing on this show is tight. The characters are interesting. And there are demogorgons.

3. Longmire

This is my most recent binge. Longmire is a modern western mystery series. The cast features some great actors: Lou Diamond Philips, Katee Sackhoff, A Martinez, and Peter Weller. The Indian characters are my favorite, especially Jacob Nighthorse. #charactercrush

4. Unbreakable Kimmy Schmidt

This is totally my kind of humor, and the story line focuses on overcoming hardships, which is my favorite theme of all time.

5. Fuller House

I grew up watching D. J. Tanner on Full House, so I had to watch D. J. Fuller on Fuller House. All the great characters come back at one time or another. Plus, seeing Candace Cameron Buré doing one-leg push-ups made me decide to work on my own upper body strength. Yes, it’s cheesy. But sometimes, you need to watch the cheese.

What are your Netflix favorites? What should I watch next?

March 24, 2018

The Finance Department: Federal Income Taxes (Part 3)

Federal Income Taxes:

Profit, Loss, and Write-offs

Federal Income Taxes:

Profit, Loss, and Write-offs

The Finance Department (Part 3)

If your book business earned $1,000 this year (aka profit or income) and you spent $1,000 on your business’s expenses (book creation, marketing, office supplies, etc.) (aka loss or expenses), how much do you owe in federal income taxes?

$0.

Why? Because your business expenses consumed all your business profits. In other words, your net profit (profit minus loss or income minus expenses) for the year was zero. And you only pay taxes on your net profits.

That is why keeping records of all your book business expenses is so important. How much you invest in your business makes a huge difference in how much you owe in taxes! Remember we aren’t talking about discretionary spending. You can only write off items that you had to buy in order for your business to exist.

Making the effort to document and store your receipts may seem like a waste of time, but apathy will cost you. Consider the following example. (Note: For the sake of keeping this simple since there are so many variables, I’m assuming that through other income you are already above your standard or itemized deductions. This example also assumes that you fall in the 10 percent tax bracket. If you fall into a higher tax bracket, then the value of your receipts is even more.)

Your books earn $1,000.

You spent $1,000 on book business items.

So, in your book business bank account, you currently have $0.

Tax Time! The federal government is already aware that you earned $1,000 (thanks to 1099s submitted by publishing platforms).

If you saved your receipts and documented your expenses, you would owe $0 in federal income taxes.

But if you do not provide the government with documentation that you reinvested that money, they assume it’s all profit and expect you to pay taxes on it. Therefore, you owe $100 in federal income taxes.

But you don’t have $100 in your account! Doesn’t matter. You owe $100.

Owing $0 vs $100 is a big difference!

You can throw away a lot of money by not keep records of your business expenses.

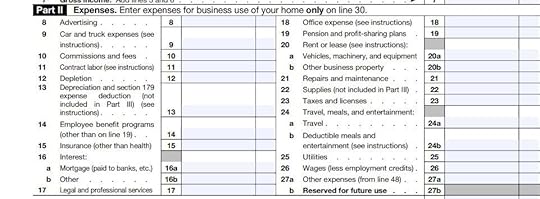

This is where the Schedule C, which we covered in last week’s post, comes into play. To review, you receive 1099 MISC forms from your publishing platforms, which tell you how much money you earned (profit/income), and you use your own receipts and records to subtract your legitimate book business expenses (loss/expenses), and that’s the number your book business’s taxes are based on.

What Are Legitimate Expenses?

From https://www.irs.gov/pub/irs-pdf/f1040...

From https://www.irs.gov/pub/irs-pdf/f1040...Examples of Items You Can Write off

mileage (trips to the post office to send books, to stores for business purchases)

shipping costs (postage, envelopes, packing material)

giveaway items (cost of items used for marketing giveaways)

advertising (online ads, book marketing services)

cover art purchases

font purchases

royalty payments to coauthors or writers you published

conferences related to your business

research trips related to your books

subcontractors (graphic designers, editors, typesetters)

office supplies and equipment (laptop/computer, flash drives, printer, paper, ink, pens)

home office (portions of property taxes, utilities, interest on mortgage, insurance)*

Examples of Stuff You Cannot Write off

Starbucks beverages (even if you write there)

book purchases unrelated to your research

tax compliance efforts and products (tax software and accountants)

Remember: You could be audited one day, and you must be able to defend every single item you have chosen to write off. Do not try to stretch it and claim iffy deductions. The IRS isn’t known for its gullibility. They won’t buy it, and you’ll not only pay back taxes but also hefty fines.

The Takeaway

Keeping records of your business expenses could save you a sizable amount of money in federal taxes. If you make recordkeeping part of your work routine, it will save you a lot of hassle at tax time. Create digital copies of all your business receipts and file the originals in a safe place. When tax time rolls around, you’re ready to fill out your Schedule C. Then, store them away again. Keep all your receipts for seven years in case you are audited and need to defend your decisions.

*More on these subjects later.

Disclaimer : Don’t trust me. Go to IRS.gov and confirm the information for yourself. I’m not responsible if you get audited. Also, state income taxes are separate beasts, and you’ll have to tame them for yourselves unless you are fortunate enough to live in a state without them.

Want to keep up with the Book Business for Indie Publishers series?

Want to keep up with the Book Business for Indie Publishers series?

Sign up for email notifications and receive free spreadsheet templates and PDFs for use in your own business!

#mc_embed_signup{background:#fff; clear:left; font:14px Helvetica,Arial,sans-serif; width:100%;}

/* Add your own MailChimp form style overrides in your site stylesheet or in this style block.

We recommend moving this block and the preceding CSS link to the HEAD of your HTML file. */

Yes, Keep Me Updated!

March 16, 2018

The Finance Department: Federal Income Taxes (Part 2)

Federal Income Taxes: Schedule C and Quarterly Payments

The Finance Department (Part 2)

In the US Federal Income Tax system, there are two paths of taxation: personal and business. Most indie publishers operate as sole proprietorships, which fall under personal income taxes (not business or corporate as one might think). Essentially, indie publishers are self employed, and there is no distinction between personal finances and business finances.

You file one tax return: the 1040 (the US Individual Income Tax Return).

In order to account for your book business on the 1040, you must also complete a Schedule C, which is for figuring your profit or loss from a sole-proprietorship business.

The final figure on the Schedule C becomes a line item on the 1040 form.

It’s all part of your personal income taxes.

If all your sources of income combined earned $400 or more, you must file an income tax return. See IRS.gov for more info.

To fill you the form Schedule C, you’ll need a record of the payments you’ve received throughout the year. These may come as 1099 Misc forms from publishing platforms such as Amazon Kindle, Barnes and Noble, iTunes, Kobo, and Smashwords. The deadline for filing 1099s is January 31. They may come in the mail or email, but you will also be able to access them at each publishing platform’s website.

It’s important to note that just like the 1099s you may have sent to your editors and designers, publishing platforms send one copy to you and one copy to the government. So the government already knows that the money has changed hands. If you do not report your income accurately, you can be fined.

Also important: 1099s are only required for yearly earnings of $600 or more. If you earned $599 from one platform, you may not receive a 1099; however, you must still report it as income. So keep good records!

Quarterly vs. Yearly Payments.

If publishing is your only form of income, you must make quarterly income tax payments.

Why?

If you worked a “regular job,” federal taxes would be removed from every paycheck and sent to the government. Because you are self-employed and do not receive such paychecks with tax money already withheld, you must do it yourself. Instead of sending one lump sum of money on April 15, you must send quarterly payments in order to avoid paying late payment penalties. See Form PUBL 17 for all the details.

However, if you or your spouse is an employee of another business, you have the option of adjusting your yearly withholdings from the “regular job’s” paycheck to cover the taxes your both incomes. Essentially, your monthly withholdings from the “regular job” would take into account the quarterly payments needed for your book business.

For more information on quarterly tax payments, go here.

Next week, we’ll delve into business deductions. If you have any questions about quarterly payments or deductions, leave them in the comments below.

Want to keep up with the Book Business for Indie Publishers series?

Want to keep up with the Book Business for Indie Publishers series?

Sign up for email notifications and receive free spreadsheet templates and PDFs for use in your own business!

#mc_embed_signup{background:#fff; clear:left; font:14px Helvetica,Arial,sans-serif; width:100%;}

/* Add your own MailChimp form style overrides in your site stylesheet or in this style block.

We recommend moving this block and the preceding CSS link to the HEAD of your HTML file. */

Yes, Keep Me Updated!

March 6, 2018

The Finance Department: Federal Income Taxes

Federal Income Taxes

The Finance Department

Taxes are a fact of life. As an indie author, you need to take them seriously, but there’s no need to panic when tax time arrives. If even Einstein thought the income tax was difficult to understand, then obviously the US federal tax code—and the accompanying load of regulations—is complicated.

Because the ultimate responsibility for filing your income taxes lands only on you—not your accountant or tax preparer—you need to have a good understanding of the basics of both federal and state income taxes. You should understand the forms well enough to be able to explain your choices to an auditor if it comes to that.

In this blog series, I’m going to give you an overview of the basics. I won’t simplify quite as much as Oscar when he tries to explain a budget surplus to Michael Scott in The Office, but you get the idea. Please note that I’m not a tax expert, so always verify anything you read here at IRS.gov.

The Office – LI5 Surplus from Ryan Faucett on Vimeo.

As with many of an indie author’s tasks, you can choose to hire a tax preparer or accountant to help with your income taxes, or you can prepare and file them yourself. If you are not comfortable handling your taxes alone, don’t hesitate to get professional help. However, even if you hire a professional, you are ultimately responsible for ensuring the correctness of the tax documents that you send to the government.

You collect 1099s from vendors.

You gather other income data that did not require 1099s.

You maintain records of your business expenses, such as mileage.

You keep receipts for business expenses.

You must sign and submit the tax forms.

You must store all records for seven years and be prepared to defend them in the event that you are audited.

Due to the limitations of space and time, this series will cover the basics of personal, federal income taxes in the United States. State taxes vary, so you’ll have to research the details yourself.

If you have any questions, please ask them in the comments, and I’ll do my best to answer or point you in the right direction. In the meantime, here are some resources to get you started:

Tax Preparation Software

H&R Block

TurboTax

Tax Preparation Books

K. Lasser’s Your Income Tax 2018:For Preparing Your 2017 Tax Return

Want to keep up with the Book Business for Indie Publishers series?

Want to keep up with the Book Business for Indie Publishers series?

Sign up for email notifications and receive free spreadsheet templates and PDFs for use in your own business!

#mc_embed_signup{background:#fff; clear:left; font:14px Helvetica,Arial,sans-serif; width:100%;}

/* Add your own MailChimp form style overrides in your site stylesheet or in this style block.

We recommend moving this block and the preceding CSS link to the HEAD of your HTML file. */

Yes, Keep Me Updated!