The Book is Coming (and Why I Wrote it)

Visit my author’s website for more information.

Visit my author’s website for more information.When I first began writing Suit Yourself: A Portfolio Strategy for Every Personality Type, I had no idea how deeply personal this project would become. What started as a concept to blend two of my passions—investing and personality psychology—quickly evolved into something more introspective and meaningful. It became a lens through which I could reexamine my own financial habits, biases, and identity. And now, after years of development, research, interviews, writing, and countless rounds of editing, I'm thrilled (and relieved) to say that the manuscript is complete and heading into layout with Koehler Books.

Even before the manuscript was sent to the editor, I had revised it countless times and probably killed a few trees in the process!Message Recap: Don’t be a Copycat Investor

Even before the manuscript was sent to the editor, I had revised it countless times and probably killed a few trees in the process!Message Recap: Don’t be a Copycat InvestorSuit Yourself is a book about making investing personal using the Enneagram. I have written about this topic on Substack through a series of articles covering all nine personality types, but Suit Yourself takes it to another level of detail and scope. The book is not in a self-help-y, just-follow-the-author kind of way, but in a practical, structured, and psychology-informed manner. The core idea is simple: the best and most sustainable investment strategy reflects who you are.

Using the Enneagram to Frame the Book The Enneagram as a framework for

Suit Yourself: A Portfolio Strategy for Every Personality Type

The Enneagram as a framework for

Suit Yourself: A Portfolio Strategy for Every Personality Type

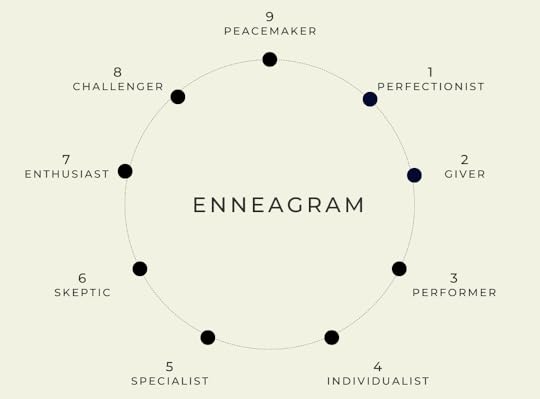

The Enneagram—a model of nine personality types—is the framework I use to map out Suit Yourself. Through each chapter, readers will discover how their personalities influence risk tolerance, decision-making, reactions to market stress, and overall investing mindset. From Type One perfectionists to Type Nine peacemakers, I unpack how each type behaves with money. Suit Yourself is a book about self-awareness, behavioral finance, and taking ownership of your financial journey. It is for anyone who has ever wondered why they sell too early, hesitate to invest, chase small-cap stocks, or avoid looking at their financial roadmap altogether.

My diverse experience in investing, finance, accounting, technology, and clinical mental health helped shape this project. So did the incredible conversations I have had with friends, quiz-takers, readers, and fellow investors over the past few years. Thank you to all of you who took my personality quiz, offered feedback, or just cheered me on from afar.

Timeline for Suit YourselfThe book is going through its due process with the publisher, and we are estimating a late 2025 release. I will be sharing more in the coming months—cover reveal, pre-order details, giveaways, maybe even some bonus content. Until then, I just wanted to say thank you for being here. This Substack has been a quiet but steady companion throughout this journey, and I am excited to share more with you soon.

Meanwhile, below are the posts I have written about Enneagram types and their stock-picking habits:

Enneagram x Stock Picking (Part I): Type One Perfectionists

Enneagram x Stock Picking (Part II): Type Twos Investing in AMC to Save Movie Theaters?

Enneagram x Stock Picking (Part III): Type Three Investors, Successes, and Delaying Gratification

Enneagram x Stock Picking (Part IV): Type Four Investors and their Emotions

Enneagram x Stock Picking (Part V): Type Five Investors inside their heads

Enneagram x Stock Picking (Part VI): Type Six Skeptics

Enneagram x Stock Picking (Part VII): Type Seven Enthusiasts

Enneagram x Stock Picking (Part VIII): Type Eights

Enneagram x Stock Picking (Part IX): Type Nines

To find out more about your typology, try the free quiz on my website.

Follow me on X.com (formerly Twitter) @ConsumeOwnTech

Thanks for reading Consume Your Own Tech Investing! Subscribe for free to receive new posts and support my work.

Subscribe to Consume Your Own Tech Investing FOR FREE to receive a welcome email with the following:

My Top 10 high-conviction portfolio positions, combining value and growth stocks

Book recommendations in investing, consumer, and tech sectors

Monthly articles delivered straight to your inbox

NOTE DISCLAIMER: This blog does not represent investment advice and is solely the author’s opinion. Contents herein are for educational purposes only. Any discussion here is not an offer to sell or the solicitation of an offer to buy any securities of any company. The author is not a stockbroker or financial adviser. Consume Your Own Tech Investing makes no representations, and specifically disclaims all warranties, express, implied, or statutory, regarding the accuracy, timeliness, or completeness of any material contained in this site. Consume Your Own Tech Investing recommends that you do your own due diligence. Please see the full Disclaimer on the About page for more detail.